Health Insurance Glossary

Learn more about your Health Insurance Concepts!

It is a fact that diseases and accidents are unpredictable. Private medical care can result in an expense, unplanned, that could impact your family's economy. For this reason, it is important to anticipate coverage for you and your family in case of illness and accidents using a Health Insurance, which will allow you to assume only a part of the expenses generated instead of 100%, this way you can feel prevented in case of your health or your family's health is affected.

BlueNetHospitals, in Los Cabos, allows you to cover the expenses generated by your medical care using your Health Insurance, accepting the policies of most major domestic and international insurance companies.

By contracting a Health Insurance, you will be contracting a coverage* for Hospitalization expenses, Surgical Interventions, Medical Treatments, Laboratory Studies, Radiology and Imaging Studies, Medications, and Medical Fees. (*Coverage will vary according to the insurer and the plan contracted).

We know that Health Insurance has terms that may seem unfamiliar or confusing to you, so here is a list of the most commonly used concepts in your insurance policies and their definitions to help you better understand what they are about (the following are concepts mostly based on a Mexican Insurance Policies. There may be some differences in how Mexican, American, or International Health Insurances Plans refer to the following concepts. If so, our specialized Insurance Team will help you).

Main Insurance Concepts you should be familiar with

Insured Amount

It is the maximum amount paid by the insurance company you chose for each insured person within the policy as a result of the covered illness or accident that may occur, all according to the conditions stipulated on the title page of your contracted policy.

This amount can be determined in Mexican Pesos, American Dollars, U.M.A.M. (Unit of Measurement and Monthly Update), or, although rare, it may have no limit.

Deductible

A fixed amount that the insured must pay as a result of each illness or accident occurs (some insurance companies offer zero deductible in accidents). The insurance company will pay medical expenses from the amount exceeding the deductible in cooperation with the co-payment.

The insurance will not pay medical expenses involving an amount equal to or less than the deductible. The deductible can be found on the cover of your policy.

Co-payment

Percentage defined from the moment the policy is issued. It is an amount that you must cover for each illness or accident that occurs based on the expenses covered after the deductible.

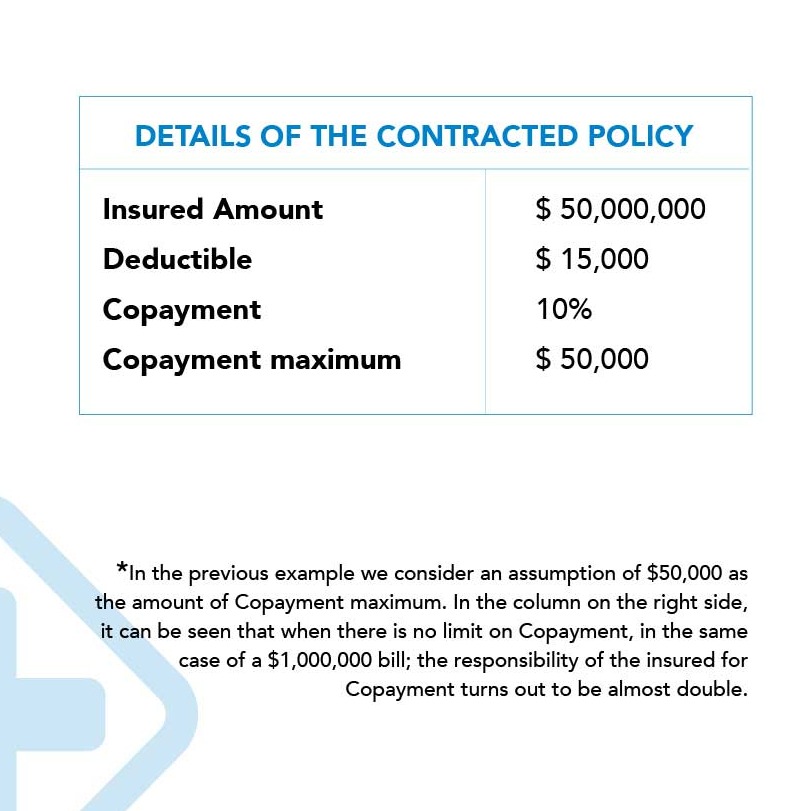

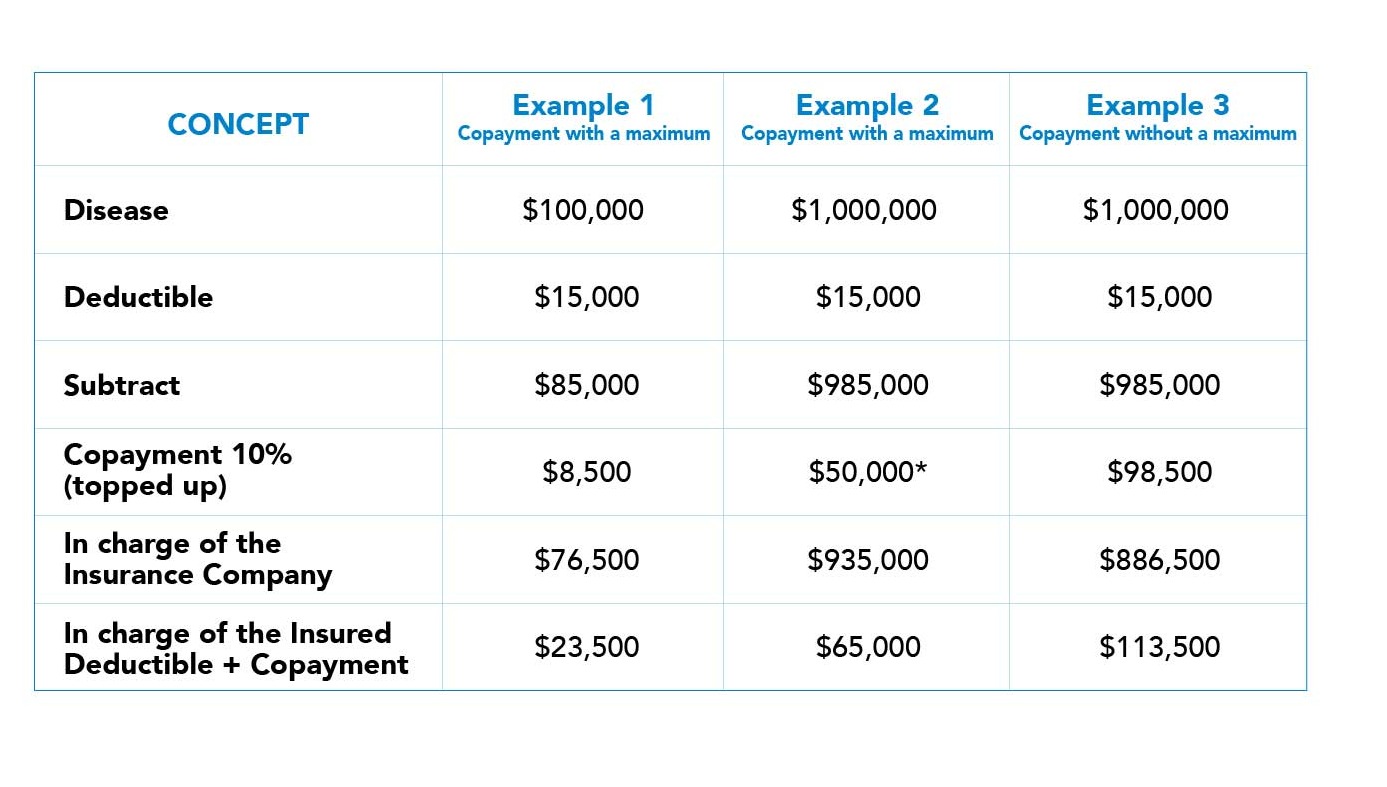

There are insurance companies that offer the option of defining a co-payment maximum, that is, a maximum amount that will be your responsibility to cover for each illness or accident. Considering that a serious situation may arise in which the expense is high, it is very convenient to have a co-payment maximum.

Below are several examples that can help you better understand the concepts of deductible and co-payment, with a limit and without a limit.

It is essential to keep in mind that each insurance company offers different deductibles and co-payments, and both concepts impact the policy's cost.

Waiting Period

When you get a Health Insurance, you have the idea that you will be able to take advantage of the benefits immediately; however, there are some exceptions to consider.

Insurance companies try to avoid policies that are only issued to treat an urgent illness and then canceled or to treat a pre-existing disease when it is one of the main exclusions. That is why Health Insurance policies have so-called waiting periods.

Commonly, from the policy date of issue, the benefits of the coverage are immediate in case of accidents. In the case of illness, in general, there is a waiting period of 30 days.

Typically, the coverages that have a more extended waiting period are cases such as Maternity (Natural Childbirth or Cesarean), AIDS, sinuses, tonsils, adenoids, hernias of any kind, renal lithiasis, cataracts, gynecological problems, among others. Waiting times vary for each illness, and all of these will be indicated in your contracted policy.

Pre-existence

An illness or condition that began before the health insurance was issued and is therefore not covered by the insurance.

Exclusions

Illnesses or treatments that the insurance company does not cover. Depending on the insurance company, the most common are: cosmetic surgery, psychiatric studies, congenital conditions, homeopathy, accidents or illnesses due to the consumption of drugs, or the practice of a sport professionally, among others.

Guarantee Letter

Document issued by the insurance company addressed to the Hospital, confirming your coverage for Hospital expenses, deductible, co-payment, and Medical Fees.

Doctor's Fees

Amounts established by the insurance company for the payment of hospital services or the amount of the fees of the attending Physician and/or surgical team.

Procedure to schedule a Surgery

Scheduled Surgery

When it is an elective or scheduled (non-urgent) procedure, the insurance company will issue a guarantee letter addressed to the Hospital, confirming the surgery to be performed, the treating physician, the initial coverage for the surgery as well as the deductible and co-payment. The documents needed to request this guarantee letter are:

-

Medical report.- to be completed and signed by the treating physician. This includes the medical history and diagnosis of the insured requiring the surgery.

-

Notice of accident or illness.- Must be completed and signed by the insured and/or contracting party. It includes general information about the insured or the affected insured.

-

Medical tests that prove the diagnosis of the illness to be treated or surgery.

-

Official identification.

-

Cover or credential of your policy.

BlueNetHospitals has a team of insurance specialists who will gladly provide you with advice on the use of your Health Insurance policy. Some insurance companies allow the Hospital to handle this guarantee letter, and others require that the insured be directly responsible for the procedures. Invariably, our Insurance team will be able to advise you on this matter.

Emergencies

In the event of an accident, hospitalization, or emergency surgery, the Hospital will be able to carry out all administrative procedures directly with the insurance company.

There are two options for payment of medical expenses

Direct Payment

This option means that the insurance company will pay the Hospital directly for the medical expenses arising from your care, as long as the Hospital is within the insurance company's network. The amount to be paid will be based on the concepts mentioned above, such as coverage, deductible, co-payment, etc.

A common requirement for Direct Payment to be applicable, even if the care exceeds the deductible and co-payment, is that your hospitalization is at least 24 hours.

Reimbursement

This option implies that the insured will first pay for all your medical expenses and then request the insurance company to reimburse them. The documents that you will have to submit to the insurance company to claim your reimbursement are usually.

-

Medical report: to be completed and signed by the treating physician. This includes the medical history and diagnosis of the insured.

-

Notice of accident or illness: must be completed and signed by the insured and/or contracting party. This includes general information about the insured person or the affected insured person.

-

Laboratory, radiology, or image studies, as well as the prescriptions of the treating physician that prove the diagnosis.

-

Official identification.

-

Cover or credential of your policy.

-

Bills paid to the Hospital, Pharmacy, Medical Fees, or other expenses incurred during your care that is covered within the conditions of your policy.

Having Health Insurance is a beneficial alternative to cover the expenses especially in a severe case, which will allow you to lighten the cost and prevent a possible impact on your family's economy. It is an investment, which "is better to have it and not use it than to need it and not have it."

Currently, there is a wide variety of options on the market, many of which are very good and which adapt to the needs and possibilities of each person or family.

The ideal is to seek the advice of a professional, expert Insurance Broker and/or Agent who can offer different alternatives, who can take the time to understand your needs, explain in detail each of the conditions or scenarios that the offer contemplates and very importantly who has the availability and capacity to support you when you need to use your policy.

In BlueNetHospitals, our priority is your health and your family's, that's why we have a team of specialists in Health Insurance Policies. If needed, We can refer you to a Broker and/or Insurance Agent who will help you find the ideal policy for you.

BlueNetHospitals - Hospital Los Cabos

BlueNet Hospitals.

Trending Topics

Health Insurance

Trending Topics

Septoplasty

Septoplasty is a highly effective procedure for correcting a deviated septum

Ulcerative Colitis

Ulcerative colitis is an inflammatory bowel disease (IBD) that causes chronic inflammation.

Prostate-Specific Antigen (PSA)

The level of PSA in the blood can provide valuable information about prostate health.

Emphysema

Emphysema symptoms can be subtle at first but tend to worsen over time.

Health Library

Health Insurance

- ¿Necesitas una cita con un Especialista?

- llámanos

- escríbenos

- Conéctate

.webp?q=EKaleijvv67VJNbp)

.webp?q=1FZKiH3re6aE7vMp)